Nothing dampens a Disney trip idea more than having to cancel it because of a last-minute emergency, and what’s more, with a penalty! However, Disney World travel insurance can save you the trouble of worrying about such scenarios.

Travel insurance is one of those things you buy but may never use. However, for peace of mind, it is well worth it.

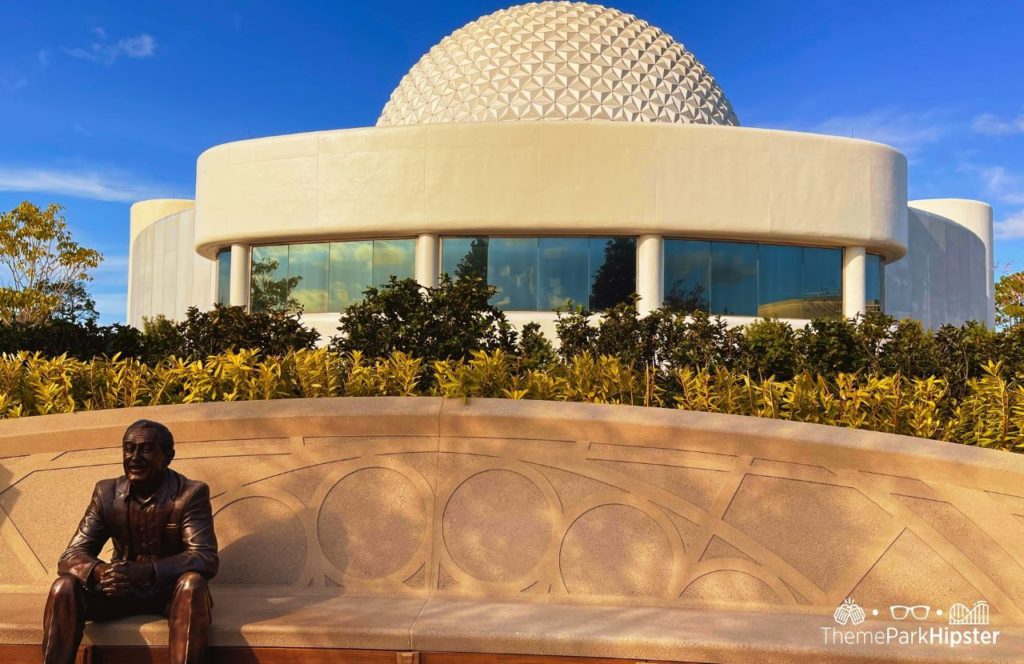

Walt Disney World may be the Most Magical Place on Earth, but even there you can run into problems. The idea isn’t to be pessimistic but to think ahead.

Pre-planning for a troublesome situation will not only save you lots of bucks, it also provide an immediate solution.

So, let’s talk about Disney World travel insurance in detail.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on certain links, I may receive a small commission at no additional charge to you.

Disney World Travel Insurance at a Glance:

- Disney offers a Travel Protection Plan for your next Disney World Resort vacation package that can be purchased any time prior to your final payment

- It is available for Walt Disney World, Disneyland Resort and Aulani, and Disney Resort & Spa packages

- If you are an adult traveling with a minor, the minor gets covered under insurance automatically in the per-adult price

- Disney travel insurance includes trip delay interruption and cancellation, baggage delay or loss, emergency medical protection, and more travel insurance benefits

Keep reading for the full guide to the Disney World Travel Protection Plan to find out if it is worth it for your next Disney vacation!

Disney World Travel Insurance

The Disney World fandom is aware of the hurricane season (also hurricane policy), and we can’t forget about the past pandemic that 2020 has brought us.

It sent the magical world into closure for the longest time in history. We all will need to take special measures as a precaution against the slimmest chance of any mishap.

In short, after our experience with a global crisis, it is a good reminder that travel insurance has become imperative for any near-future Disney trips.

How do you go about your Walt Disney World travel insurance?

Here’s a brief idea.

If you’re buying a vacation package, you will get the option to buy the Disney Travel Protection Plan (DTPP) as an add-on.

If you are going with a room- or ticket-only purchase, then you will need to look for insurance outside of Disney.

Read on to get into the details.

Get the best price on your Walt Disney World Vacation Package… Guaranteed!

Do I Need Disney World Travel Insurance?

After all, what could go wrong at the most magical place? This is a common question that pops up in everyone’s mind, even mine when thinking of getting insured for any major trip.

Most likely, you’ve already traveled to a lot of places without getting into insurance, then what’s the big deal now?

The answer is mostly yes.

Travel insurance is optional and might even seem like yet another expense, but there are several reasons why it could be a good idea to buy it. Some of them include:

- Cancellation of your flight

- Hurricanes at Disney World

- Last-minute need to cancel the Disney reservations

- Loss of baggage

- Sickness or injury on the trip

Disney is indeed known to show compassion towards last-minute cancellation emergencies. They make bookings flexible and re-adjustable.

But there is no guarantee that this is what will happen for you.

That’s when the insurance will come to the rescue.

So, before you ignore the idea of getting insured, ask yourself, if you:

- are traveling during Hurricane Season i.e. June-November

- going during Peak Hurricane Season i.e. August-September

- or anyone you’re traveling with suffers from pre-existing health issues

- know that your flight tickets are refundable

- will lose a large sum of money on canceling Disney reservations

- are flying during weather that causes flight cancellation

- need to cut short the trip and return home early

In case by answering these questions, you figure you need the insurance, here is detailed information about your two best options – Disney Travel Protection Plan or a third-party insurance.

All About Disney World Travel Protection Plan

As mentioned before, it is Disney’s (Aon Affinity-contracted) insurance plan that is exclusively for guests who purchase Walt Disney World vacation packages.

It has many benefits ranging from reimbursements to medical protection. Most importantly, it is affordable.

Much like auto insurance, Disney Travel Protection Plan cost is quoted based on age. It costs around $95 per adult.

The insurance provides the best price value for those aged 70 or above. If you are an adult traveling with a minor, the minor gets covered under insurance automatically.

Another good thing about this Disney trip insurance is that it is easy to purchase since it pops up as an option when you book a vacation.

A big caution is to wait until you’ve reached the final payment window before adding the insurance or any type of Disney feature. Just in case the website becomes buggy and messes up your order.

Note that the Disney Travel Insurance Plan will generally not cover extra components like the party tickets.

In short, if you are booking your rooms separately from the tickets, you might have to skip this option. Also, if you are not buying a vacation package, then you are typically not eligible either.

So, let’s discover and talk about the next best option – third-party insurance.

WATCH: 13 Beginner Tips for Going to Disney World This Year!

Is Third-Party Disney World Insurance Worth It?

The biggest difference between the Disney Travel Protection Plan and third-party insurance is that Disney will only cover you inside its own premises.

This means if you are planning to tour more than just Disney World, then the rest of your trip goes uncovered.

Depending on which travel company you choose to approach, you might even get away with more insurance coverage at a lesser price compared to DTPP.

But, if you are thinking about which is the best travel insurance for Disney World, I do not have a cast-iron answer for it. Speaking with experience, my recommended company for Disney travel insurance would be Travel Guard®.

Say, for instance, you decide to visit Orlando during the hurricane season and you plan on visiting more than just Walt Disney World. While you’re most likely iffy about getting insurance, it may be best to go for it.

Traveling to Walt Disney World is not the cheapest thing in the world, so to give yourself peace of mind, it would be great to add on a third-party company to help you with your Orlando trip.

The only frustrating part of getting insured through a third-party company is that you might need to contact an agent. It is also not as effortless as checking a box.

However, most sites make it easy to go through to find what you need quickly. You can also use your Authorized Disney Vacation Planner to help you with this addition.

Have a DIFFERENT kind of Orlando vacation with a Resort home next to Disney World. Find Your Disney Resort Vacation Rental here!

Considerations to Think About When Buying Disney World Trip Insurance

Now that you know your options, let’s talk about some things to consider when buying the insurance.

Disney Trip Insurance Cost

Considering the price of insurance is particularly essential because you are buying something you are not actually hoping to use.

We already know the price of the Disney Travel Protection Plan – $95 per adult and the cost of a child that is under the age of 17 is included in the adult price.

What does Disney Travel Insurance cover?

- Trip Cancellation/Trip Interruption: Reimburses up to total trip cost of the prepaid travel arrangements due to illness, injury, and non-medical reasons such as job loss, military service, and more

- Trip Delay: Reimburses related expenses, up to $600 ($200 per day) if your trip is delayed for 6+ hours

- Baggage Loss: Reimburses up to $2,000 for lost, stolen, or damaged luggage and personal effects ($500 each item/$500 aggregate limit)

- Bag Delay: Reimburses up to $500 for the purchase of necessary personal items if your bags are delayed 12+ hours

- Emergency Medical Protection: Provides up to $25,000 of coverage if you get ill or injured on your trip

- Emergency Evacuation/Repatriation: Arranges and prepays for emergency medical transportation and other covered expenses up to $100,000 max limit

- Travel Accident: Provides up to $25,000 in the event of accidental death or dismemberment

- Rental Car Damage: Reimburses repair costs up to $25,000 in the event of collision, theft, damage or vandalism to rented vehicles

Resource: Arch Insurance Company

Third-Party Insurance

The prices of third-party insurances are also easy to get such as Travel Guard.

When booking it from a third-party source, make sure you get the best coverage for things mentioned above, from bag delay/loss, to car rental damage to booking cancellation.

What does Travel Guard insurance cover?

- Trip Cancellation

- Trip Interruption

- Medevac

- Travel Medical Expenses

- Baggage Coverage

- Baggage Delay

- Travel Inconvenience

- Children Covered at No Additional Cost

- Much more!

Affordable Deductible

When it comes to Disney travel insurance, you will find several extremely cheap options. Here is a catch to look out for. Most cheap policies have high deductible prices.

For example, if you were to lose your baggage and claim for $1400 through a policy with $500 excess, you will pay the $500 while the insurance covers the remaining $900.

So, before you go for an extremely cheap insurance policy, learn what your possible deductible could be and see if you can afford it.

Choose the BEST Day to Go to Walt Disney World with This Crowd Calendar!

Travel Destinations

You’re traveling to Disney World, I get it, but is there any place else you’d like to explore while in Florida? The question seems pretty simple and impromptu plans are always a possibility.

So, if you are not getting DTPP, then make sure to get all expected destinations covered under one of the top third-party Disney trip insurance plans.

Get a Medical Report

Whether it is hypertension, diabetes, asthma, or even chronic pain, it is important that you get a medical report for it.

Most insurance policies won’t cover a lower-risk ailment unless you declare it or, in some cases, you may pay extra. However, remember to be honest with your travel insurance providers.

If you’ve been seeing a physician or chiropractor, let them know about it.

Underlying or a chronic health condition can show up anytime during the trip. You don’t want the vacation to get spoiled because of it.

Extra Cover for Certain Elements

Areas inside as well as surrounding Disney World are teeming with things to do. They include a variety of adventures that might need extra insurance coverage.

If on your trip, you are planning to go horse riding, surfing, or biking, be sure to check that the policy you choose covers you.

Hipster Power Tip: Use websites like Insuremytrip.com to compare trip insurance rates.

Equipment Cover

Crime in Disney is almost non-existent, but if you are anything like me, you’d want to keep an eye on your belongings. Especially if you’re traveling alone.

Secondly, you never know if you may end up losing your mobile device or expensive camera while on your Disney vacation.

To avoid the financial headaches that may occur as a result of this, be sure that you store you money in a safe place. You’ll also make a list of all equipment and other expensive belongings, and that you give this information to the travel insurance provider.

This will help you see what is covered and what is not. Plus, due to a surge in mobile-recoup claims, many insurers have begun to offer coverage for them.

Hipster Power Tip: Check with your credit card company to see if they offer travel insurance. They may not cover your full trip, but the options may be enough coverage for you without the additional fee.

Frequently Asked Questions about Disney Travel Protection Plan

Now that we have the basics covered, let’s go through some of the most common questions when it comes to getting some type of Disney World travel insurance.

Can I add the Disney Travel Protection Plan after making the reservations?

If you have not made the final payment, you should be able to get travel protection added to your vacation package by calling the Walt Disney World Resort at (407) 939-5277.

However, you should either be at least 18 or have a parent/guardian permission to make the call.

Is the price of the Disney Protection Plan refundable?

The insurance comes with a 14-day trial period.

If you cancel it within that period, Disney states that it will refund the entire amount of the insurance.

What is Disney’s cancelation policy for room-only reservations?

You can cancel your reservation penalty-free up until 5 days before the check-in.

A cancellation done during the last 5 days will cost you a penalty equal to the first night’s room rate.

Recommended: Top 5 Ways to Find Cheap Disney World Tickets for Your Vacation!

What are the common exclusions from travel insurance?

For most travel insurance companies, any claim made for illness or injury from an unstated sport or activity will not be covered.

This also applies to unstated equipment loss/damage, medical condition, and personal financial loss.

Will my travel insurance cover me if I can’t go?

Yes, most insurances cover cancellations.

What if my visa gets rejected and I already have travel insurance?

In this case, you will want to cancel the travel insurance policy itself because you did not take the trip. It should also be possible.

To apply for the cancellation of the policy altogether, you will need to submit the policy, copy of passport, and a cover letter explaining the trip was canceled due to denial of visa.

Ready to start planning your next Disney World vacation? Listen to the latest podcast episode on Apple or on your non-Apple device now!

Let’s Wrap It Up

Traveling to the Most Magical Place on Earth should be a worry-free business. No pandemic, medical problem, financial hiccups, or mishaps should be able to dampen your goal of having unlimited fun.

Disney World travel insurance ensures this happens.

Imagine it like a (paid) guardian angel that protects you throughout the trip. Just keep in mind that policies and prices do change constantly, so you’ll want to keep an eye on the agency that you choose to go with in case anything changes.

Since many of us wonder if it is necessary, super expensive, or effort-taking, we hope this guide was able to answer all your pressing questions.

Overall, ALWAYS CHECK YOUR PLAN THOROUGHLY!

After all, the only screaming or fear at Walt Disney World should be on the hair-raising rides.

Until next time, Happy Park Hopping Hipsters!

About the Author

My name is Nikky. I’m a wife, a mother, a pharmacist turned theme park blogger, USA Today 10Best Contributor, and a writer who loves ALL things amusement park related!

Traveling alone to the parks has changed my life and I want to show how you can create your own solo theme park memories.

Connect with me on Instagram!

UP NEXT: Ultimate 3-Day Disney World Itinerary Template

(Original Article Date: July 22, 2020/Updated by Editor on July 8, 2024)